Latest News

Blog

New SCPMG Retirement Options that may be Just What the Doctor Ordered

Earning a larger salary, as many in the medical professions do, can block you out of some of the more tax- advantageous retirement savings plans available. Roth IRA’s allow for tax-free qualified distributions in retirement, and are popular for investors who anticipate landing in a high tax bracket when they retire. While many, including self employed individuals, enjoy the benefits of the Roth’s tax deductible contributions, they are restricted by income limits. The income limit for contributing the maximum to a Roth IRA in 2022 is $144,000 filing as a single person, and $214,000 when filing jointly.

An IRA conversion, commonly called a backdoor Roth IRA, can help these higher-income earners plan for retirement while enjoying some important tax advantages. The process to participate in one of these plans begins with contributing to a traditional, nondeductible IRA. At this point, a trustee-to-trustee transfer is made, and the money in your Roth IRA becomes subject to Roth IRA distribution rules.* Any future earnings from this investment would not be subject to taxes when withdrawn. Traditional IRA account owners should consider the tax ramifications, age and income restrictions in regards to executing a conversion from a Traditional IRA to a Roth IRA. The converted amount is generally subject to income taxation.

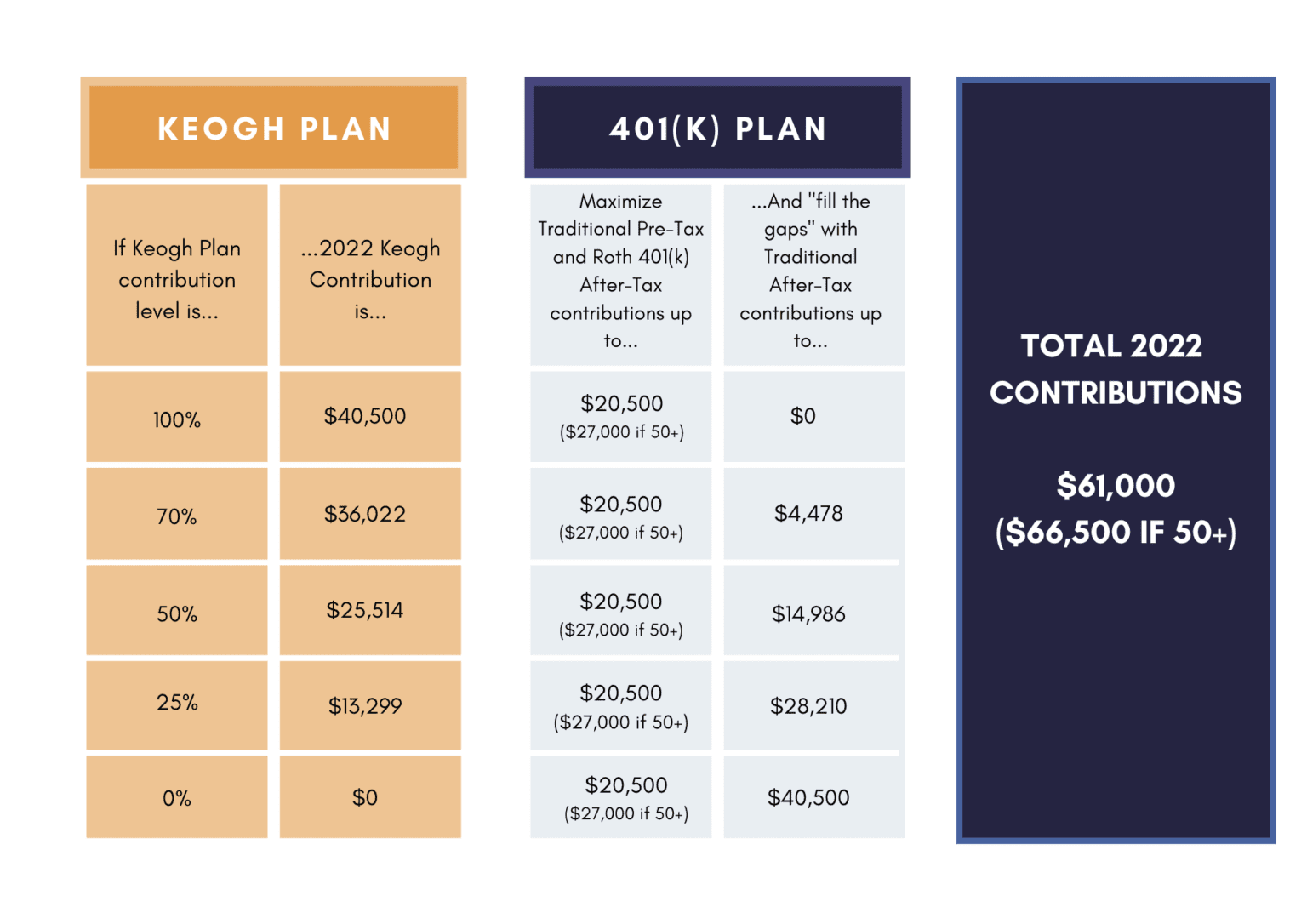

Kaiser recently announced modifications to their retirement plan options, and the chart below describes how Southern California Permanente Medical Group Employees may be able to change your contributions to maximize tax benefits. For California medical professionals who will most likely land in a higher tax bracket upon retirement and who are already beyond Roth limits, backdoor Roth IRA’s may be just what the doctor ordered.

Download a PDF of this article

*The Roth IRA offers tax deferral on any earnings in the account. Withdrawals from the account may be tax free, as long as they are considered qualified. Limitations and restrictions may apply. Wi thdrawals prior to age 59 ½ or prior to the account being opened for 5 years, whichever is later,

may result in a 10% IRS penalty tax. Future tax laws can change at any time and may impact the benefits of Roth IRAs. Their tax treatment may change.

This material was created for educational and informational purposes only and is not intended as ERISA, tax, legal or investment advice. If you are seeking investment advice specific to your needs, such advice services must be obtained on your own separate from this educational material.

LPL Financial and Stratos CA do not provide tax advice. Clients should consult with their personal tax advisors regarding the tax consequences of investing.

Nina Hajjar is a Registered Representative with, and securities are offered through, LPL Financial. Member FINRA/SIPC. Investment advice offered through Stratos Wealth Partners, a registered investment advisor and separate entity from LPL Financial.